Detecting Bot Activity in Blockchain Games and Dapps, Helping the Blockchain & DeFi community to enhance their data insights

In dapps there may very well be quite some bot activity, but not all of it is bad. However, if you’re analyzing dapps on DappRadar it is important to understand the data. In this educational article we will give you a couple of PRO tips to improve your knowledge about dapp data on DappRadar, and whether there’s bot activity involved.

Having a dapp rank high in the DappRadar Rankings will likely generate some attention from media, researchers and potential users. Web3 explorers can find various metrics on DappRadar, including Unique Active Wallets (UAW) and Transactions.

What are UAW?

In order to be fully aligned, we first need to explain Unique Active Wallets. This core metric for the dapp ecosystem measures the number of unique wallets to interact with a smart contract. Interacting would mean processing a transaction, for example swapping a token, claiming a reward, trading NFT artwork, or crafting a new game item.

This means that any activity on a DeFi platform gets automatically tracked in the UAW metrics. However, in gaming things are very different. Some blockchain games have core game activity on the blockchain, while others only offer a very limited amount of player-owned game assets. In the case of games, the UAW metric only reveals a portion of the actual player base: only the ones who have interacted with the blockchain game. Read more about Active Users vs Unique Active Wallets in gaming.

Where to find this data on DappRadar?

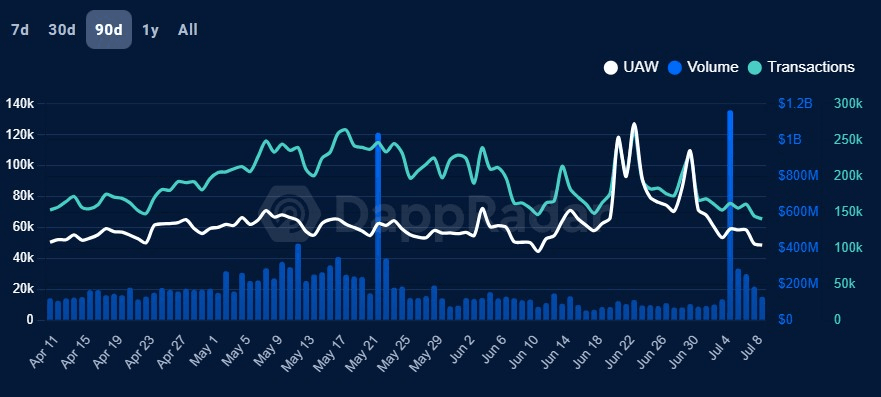

Every dapp listed on DappRadar has an Overview tab. This is the general tab that offers standard information for each dapp. Scroll down on the main product page of a dapp, and you will find a graph that looks somewhat similar to the graph below.

It shows three types of data:

- UAW – the number of Unique Active Wallets interacting with the dapp’s ecosystem

- Volume – the value of assets flowing into the dapp’s smart contracts

- Transactions – the number of transactions processed by the dapp’s smart contracts

In this particular case, you can see that this dapp shows a clear correlation between the number of UAW and the number of transactions. However, you can also see that the number of UAW peaked in June.

The relationship between UAW and Transactions

Every Unique Active Wallet that interacts with a dapp, needs to do at least one transaction. This transaction will allow DappRadar to register the particular wallet as a UAW. This means that the number of transactions recorded for a dapp is always equal or, more likely, greater than the amount of UAW recorded.

Blockchain Games that for example use a limited number of NFT characters, will only register blockchain activity when players trade those characters. However, the more game activities involve trading, looting and crafting of NFT assets or cryptocurrencies, the more transactions such a game will generate. Therefore, in gaming the relationship between UAW and Transactions will heavily depend on what those transactions mean for the game’s ecosystem.

It’s therefore safe to assume that a healthy ecosystem requires active user engagement, and therefore users should do multiple transactions per wallet. In the example above, the number for UAW peaked in June. This means that more wallets interacted with the particular dapp, but the number of transactions didn’t peak at a similar rate. Suggesting that the UAW increase brought a low amount of transactions per wallet to the dapp’s ecosystem.

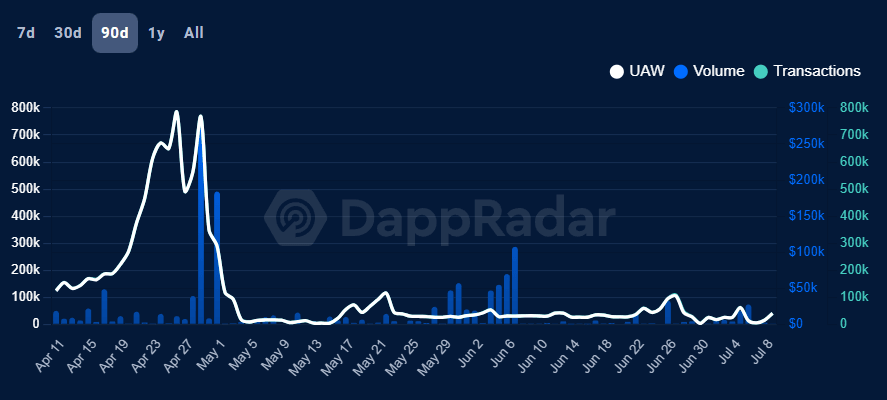

The example above is from an idle role-playing game that has its entire ecosystem and game rules built on the blockchain. Every item crafted, traded, looted or game-started results in a transaction on the blockchain game. Roughly 15,000 wallets per day generate over 400,000 transactions. The number of average transactions per wallet should fluctuate based on events, forcing users to be extra active during that time period.

When one sees the correlation between UAW and Transaction is equal to 1, or very close to 1, the data becomes questionable. Such a trend implies that the transaction behaviour made by each wallet is constant over the given period of time. But in a game, each player has different preferences and different capabilities, so their game behaviour will be very different.

Therefore, one could assume that a 1-on-1 correlation between UAW and the number of transactions processed by a dapp, reveals suspicious behavior that could indicate bot activity.

In the example shown above, the number of UAW corresponds precisely to the number of transactions. The white line (UAW) completely covers the green line (Transactions), showing that every wallet within this dapp’s ecosystem processes exactly one transaction.

Does this automatically mean that this dapp is hampered by bot activity? Not exactly, but it’s a big red flag for sure.

Is bot activity bad for dapps by definition?

A strong correlation between UAW and Transactions doesn’t necessarily mean that you’re dealing with a bad ecosystem. However, human emotion and involvement in a dapp’s ecosystem simply come with fluctuations and moments of FUD and FOMO. Therefore it’s human to see fluctuations in the correlation between UAW and Transactions.

In DeFi there may very well be a lot of automated systems, where market makers try to keep liquidity on par and MEV bots use trading strategies. Because DeFi also clearly leaks into gaming, it’s too harsh to say that bots are bad by definition. But, identifying the human element remains an important factor in assessing a dapp.

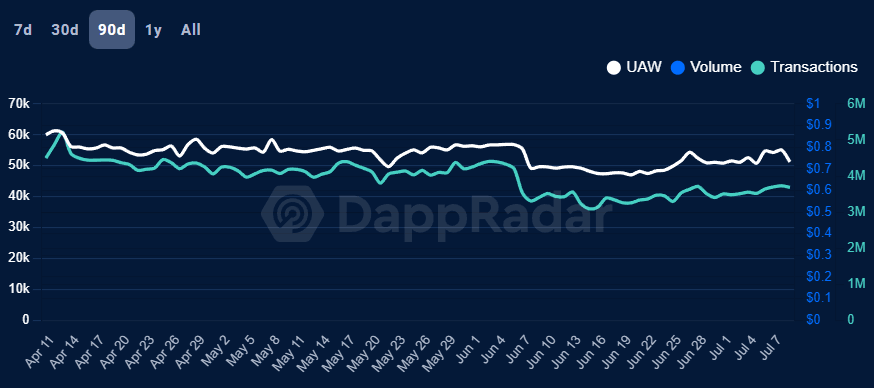

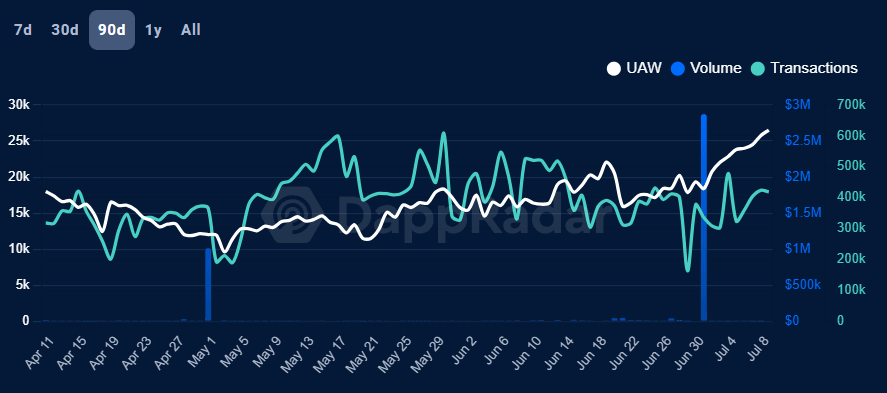

Out of the two graphs below, which dapp would you consider to be less influenced by bot activity?

Or this one?

From a human point of view, it’s safe to say that the second graph seems like a more organic ecosystem. However, this doesn’t mean that an ecosystem with bot activity should be avoided at all costs. That ultimately depends on the mechanics involved and the incentive bots have for their activity.

The golden rule

- Human activity within a dapp’s ecosystem is highlighted by irregular correlations between UAW and Transactions

- A dapp that has a consistent 1:1 connection between UAW and Transactions should raise some red flags, but this also goes up for 1:2 or 1:3.

- Dapp activity doesn’t always mean the same for every product, and therefore this data should only be a starting point for your analysis on assessing a dapp.

Join DappRadar DAO

Being a PRO member is great, and comes with all kinds of benefits. But this membership also comes with voting rights in DappRadar DAO, the organization that powers the DappRadar platform. You can use your vote to influence the direction that the platform takes by participating in governance votes. Start your journey into the DAO by joining our Discord channel.