Quick Guide To Stablecoins Mass adoption and it requires consumer protection and sensible regulation.

With a total market capitalization of over $125 billion, it is no wonder that stablecoins are capturing the attention of consumers and regulators alike. Even the giant digital payment service PayPal has its own stablecoin now. But what exactly is it and how is it safer than other crypto and NFTs? Keep reading to learn all about the many different types of stablecoins in line with the respective backing of their underlying assets.

Content

- What is a stablecoin?

- Top 5 stablecoins you should know

- Why stablecoins? Top use cases

- The different types of stablecoins

- Issues with stablecoins

- Explore trending DeFi projects

What is a stablecoin?

Stablecoins are a type of cryptocurrency that bridges gaps between the real world and the crypto realm. Regular stablecoins should be pegged one-to-one and hold their value with underlying fiat assets like the US dollar. However, there are also crypto-collateralized and algorithmic stablecoins like Makers DAI.

This simple guide will cover the use cases of stablecoin and the latter aspects.

Top 5 stablecoins you should know

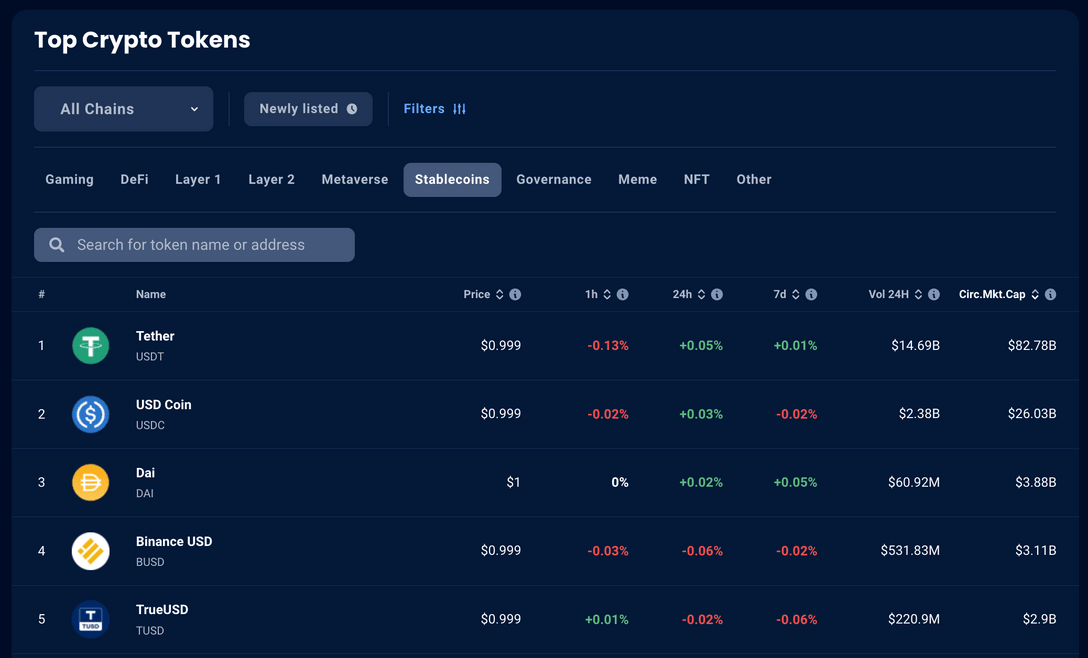

Some of the most popular and generally considered safe stablecoins include:

1. Tether (USDT)

Diving into the realm of stablecoins, Tether, or USDT, often makes the first splash. Established in 2014, it was among the pioneering stablecoins in the market. Created by Tether Limited, USDT operates primarily on the Ethereum blockchain, although it’s also available on various other chains.

It boasts a gigantic market cap, holding steady at a whopping 82.98 billion and a circulating supply matching its market cap, its 24-hour trading volume is an impressive 11.02 billion at the time of writing. Tether promises a 1:1 peg with the US dollar, though it has faced its share of controversies regarding its reserves.

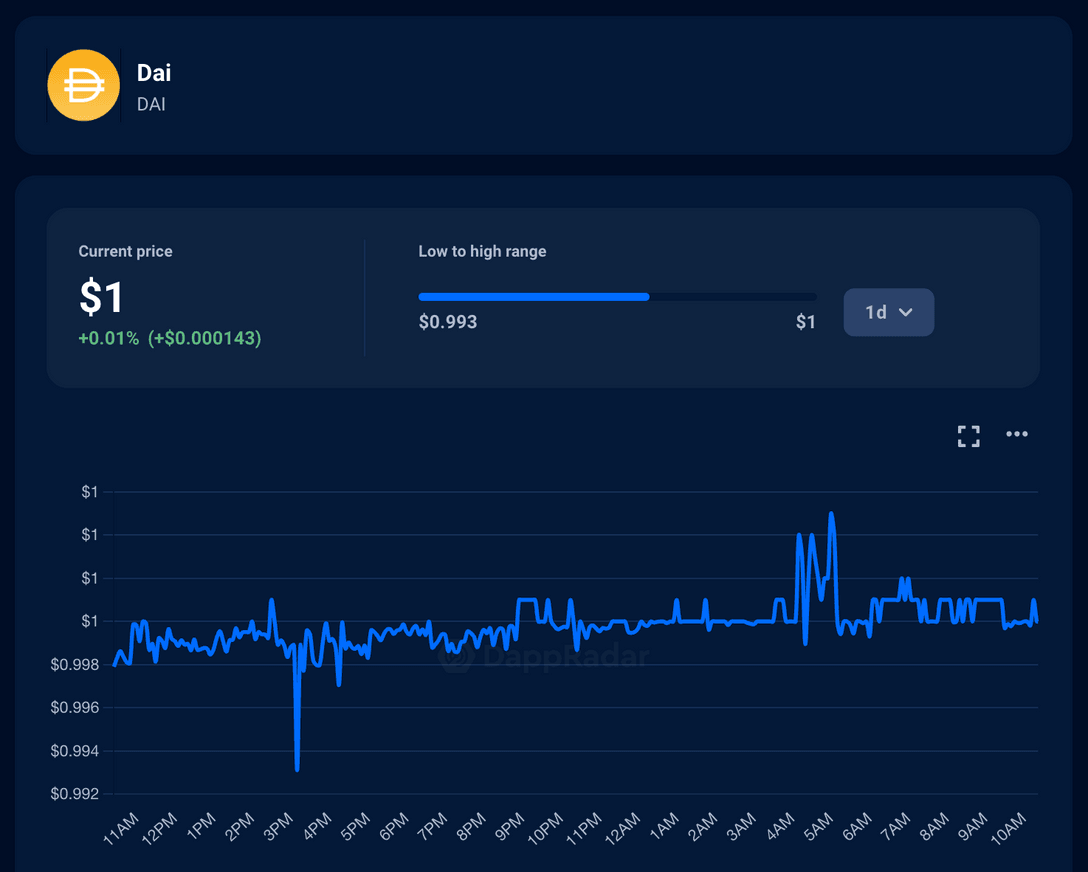

2. Dai (DAI)

Born in 2017, DAI is a product of MakerDAO and stands out as it’s not directly backed by fiat but is a crypto-collateralized stablecoin. Operating on the Ethereum blockchain, its market cap is at 3.82 billion when writing. The circulating supply mirrors the market cap, and the 24-hour trading volume is noted at 50.63 million.

What makes DAI special? Its stability is not ensured by dollar reserves but by over-collateralization with crypto assets, adding a fascinating twist to the stablecoin narrative.

3. USD Coin (USDC)

Shifting our attention, we land upon USD Coin or USDC. A product of the collaboration between Circle and Coinbase, USDC saw the light of day in 2018. Functioning mainly on the Ethereum blockchain, it carries the credibility of being fully backed by US dollars.

With a circulating supply of 26.17 billion, USDC commands a market capitalization of the same, and its 24-hour trading volume registers at a respectable 3.11 billion. USDC offers regularly audited reserves for those seeking transparency, instilling further trust.

4. Binance USD (BUSD)

Next, we find Binance USD, also known as BUSD. Launched in 2019, this coin is a creation of the colossal centralized crypto exchange, Binance, in partnership with Paxos. Operating primarily on the BNB Chain, it’s a fresh contender in the market. Yet, it’s already making waves with a market capitalization of 2.58 billion and a 24-hour trading volume of 2.18 billion at the time of writing. With its 1:1 peg to the US dollar and frequent audits, BUSD ensures it stays true to the essence of stablecoins.

5. PayPal USD (PYUSD)

August 2023 marked PayPal’s foray into the stablecoin arena with its PayPal USD (PYUSD) cryptocurrency on Ethereum. Representing another bridge between Web3 and mainstream finance, PYUSD is backed by liquid and secure assets, offering users functionalities from buying to transferring.

By September, PayPal further expanded its crypto services by introducing an “off ramp” feature, allowing easy conversion of crypto to USD. This novel service seamlessly integrates with various wallets, dApps, and even MetaMask. As for its financial metrics, PYUSD boasts a circulating supply and market cap of 44.3 million, with a 24-hour trading volume of 493,170.

Now, let’s move on to understand the purpose behind using stablecoins and what they can be used for.

Why stablecoins? Top use cases

The current financial system is very slow and despite worldwide digitalization, our money still works in analog ways. Slow transactions add to high costs and a series of other frictions affecting consumers and businesses alike.

Imagine if you could have the speed and flexibility of crypto and combine it with real-world assets minus the high volatility of crypto. This is the main value proposition of stablecoins. Let us examine the use cases of stablecoins below.

Lending in DeFi

The utility of stablecoins is very clear when lending in decentralized finance (DeFi) platforms. They serve as on-off ramps providing a frictionless flow between fiat (real money) and crypto. The total transacted amount of stablecoins in June 2022 amounts to over $590 billion.

In developing countries, stablecoins are a hedge against hyperinflation. In bear markets, investors park their funds in stablecoins because they are less volatile than other cryptocurrencies.

Remittances

In countries with hyperinflation, like Venezuela, stablecoins are an excellent tool for preserving the actual value of the money you send to your friends and family. Having a crypto wallet that supports stablecoins gives you the advantage of lower transaction costs. Moreover, you can instantly send money safely and securely.

Payroll & Invoicing

Stablecoins can significantly reduce fees and transaction costs for businesses. This is especially advantageous for mom and pops shops that do not have enough resources, larger enterprises, and the end consumers.

The different types of stablecoins

Not all stablecoins are equal and thus it is essential to understand how they work. Theoretically, the stablecoin issuer holds the actual collateral on a one-to-one basis – in either a financial institution or a traditional bank.

Here is a breakdown of the most common types:

Fiat-backed

This type of stablecoin is meant to be fully backed and redeemable on a one-to-one ratio with its corresponding fiat asset. Tether USDT and Circle USDC fall into this category.

For this model to work properly, the stablecoins must be thoroughly backed and transparently audited by trusted third parties. The largest player by market capitalization is Tether USDT, with over $82 billion, followed by Circle USDC, with over $26 billion.

The BUSD stablecoin , founded by Paxos and Binance, also falls into this category, backed by the US dollar one-to-one. Using a stablecoin such as BUSD can help significantly to hedge against periods of market volatility, and now BUSD is likely to gain momentum, after announcing that it will no longer support USDC and will convert user´s USDC into its own stablecoin BUSD.

Binance is the largest crypto exchange by volume. This move will certainly impact the landscape for the second largest stablecoin by market cap, USDC, and heat up the competition among the different stablecoin issuers.

Commodity-backed/centralized stablecoins

These stablecoins use hard assets such as precious metals like certified physical gold reserves. Issuers like Tether Gold (XAUT) and DigixGlobal (DGX) are among the top-ranking ones.

Decentralized/algorithmic stablecoins

Many advanced crypto users consider these types of stablecoins to be the most trustworthy. If the smart contract behind the stablecoin is self-auditable, savvy consumers can look into it and spot potential flaws. Other cryptocurrencies back them, and smart contracts on the Ethereum blockchain automatically stabilize their value. Smart contracts have algorithmic formulas that control supply and demand to stabilize the value.

DAI is arguably the most trusted decentralized stablecoin. It runs on Ethereum and attempts to maintain a value of $1.00. Unlike centralized stablecoins, DAI isn’t backed by US dollars in a bank account. Instead, it’s backed by collateral on the Oasis DeFi platform, which the same people behind the Maker and DAI project conceived.

Issues with stablecoins

The role of stablecoins is to maintain their pegged value and reduce volatility. Ideally, these digital assets must be 100% backed, similar to how money in our bank accounts should be fully backed one-to-one by government assets.

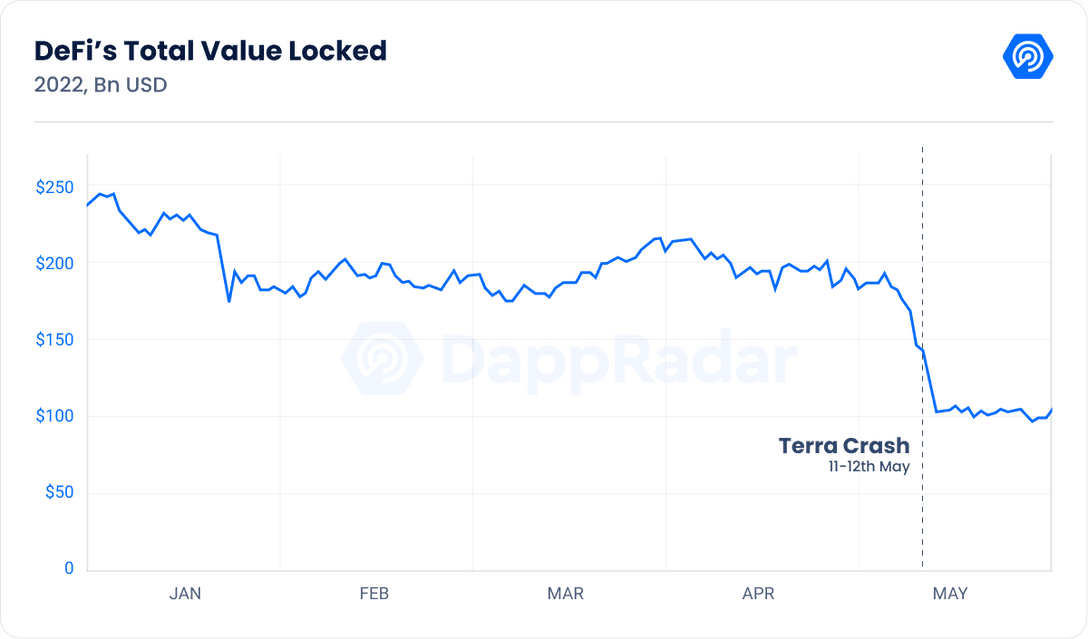

Unfortunately, there are cases where stablecoins fail to maintain their value resulting in high systemic risk and liquidity issues. According to DappRadar’s May Industry Report 2022, DeFi lost 45% of its value amid the Terra blockchain collapse.

Stablecoins and regulations

The collapse of Terra wiped off $60 billion in the most dramatic wealth loss in modern history, creating panic across all crypto assets and worsening the bear market. While the approaches vary from country to country and technology is always one step ahead, there seems to be a consensus regarding stricter regulations imposed on stablecoins. In the end, stablecoin issuers could potentially face the same stringent regulatory frames that banks must comply with. Here is all you need to know about crypto regulations worldwide.

Explore trending DeFi projects

If you’re interested in learning which cryptocurrencies are hot and trending right now, check out the DappRadar Top Crypto Tokens Ranking. Never miss a trend.

Useful links

- 5 Things to Look for When Investing in Crypto Tokens

- DeFi: What is Decentralized Finance

- What is Tron Blockchain?

- Self-Custody Matters in Crypto – Here’s Why

- 8 Ways to Check If It’s a Token Scam

Carry your Web3 journey with you

With the DappRadar mobile app, never miss out on Web3 again. See the performance of the most popular dapps, and keep an eye on the NFTs in your portfolio. Your DappRadar account syncs with our mobile app, giving you soon the option to receive alerts live as they happen.