Stablecoins are one of the most vital components of the crypto ecosystem.

The market for stablecoins has grown significantly over the last two years and is now one of the most vital components of the crypto ecosystem. Stablecoins rely on different approaches to maintain a stable value relative to one or several currencies or other assets (including crypto-assets). In contrast, others make use of algorithms to maintain a stable value. Stablecoin market capitalization surpassed $160 billion at its height and currently stands at $142.82 billion.

In 2022, the industry saw an enormous exodus of wealth from volatile crypto assets, which bolstered the significance of stablecoins. The value that left volatile holdings due to the collapse of Terra (LUNA) and the ensuing liquidity crisis moved into stablecoins. More recently, the news and legal actions surrounding Tornado Cash paint an interesting outlook for this type of asset.

Contents

- Stablecoins: what are they, and how big is the market cap?

- What keeps stablecoin pegged? Lessons learned from UST and aUSD

- Tornado Cash unveiling MakerDAO’s Achilles’ Heel

- Will Ethereum’s “Merge” affect the stability of the stablecoins?

- DeFi protocols announce new stablecoins seeking users and liquidity; will it work?

- Potential regulations that could impact the future of stablecoins

- Conclusion

Key takeaways

- In two years, the total supply of the stablecoins has increased by 816%, reaching $142.82 billion

- Tether (USDT) is the second most actively traded cryptocurrency (~60% of BTC daily trading volume) and earlier this year entered the top-10 crypto asset rankings by market value

- The dominance of Tether (USDT) decreased since 2020 by 44%

- Aave is launching a decentralized, algorithmic, yield-generating stablecoin, GHO, whose role is to enhance its lending protocol

- Circle, the issuer of USDC, and Tether, the issuer of USDT announced their support in regarding the Ethereum merge; MakerDAO (DAI) and Grayscale, the investment firm expressed concerns

Stablecoins: what are they and how big is the market cap?

Stablecoins are digital currencies stored on distributed ledger technologies (DLTs), often blockchains, that are tied to a value of reference. The vast majority of existing stablecoins are tied to the U.S. dollar, however, stablecoins may also be anchored to other fiat currencies, currency baskets, other cryptocurrencies, or commodities such as gold.

Stablecoins are distinct from ordinary digital money records, such as bank deposit accounts, in two key respects. To begin with, stablecoins are cryptographically protected. This enables users to settle transactions very quickly without double-spending or a third-party facilitator. This also enables 24-hour-a-day, 7-day-a-week, 365-day-a-year transactions on public blockchains.

Second, stablecoins are often based on programmable DLT standards that provide the composability of services. In this sense, “composability” refers to the ability of stablecoins to operate as self-contained building blocks that interact with smart contracts (self-executing programmable contracts) to produce payment and other financial services. These two fundamental characteristics allow innovation in both the financial and non-financial sectors and underlie the existing stablecoin use cases.

The use of stablecoins has skyrocketed

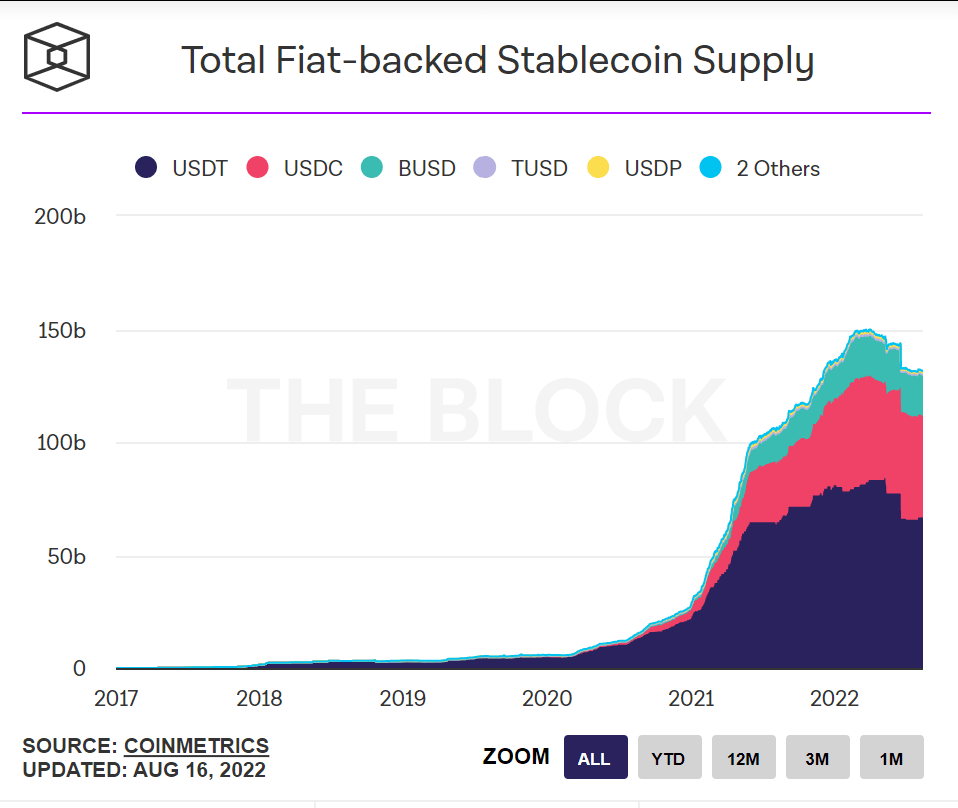

Since 2020, the use of stablecoins recorded on public blockchains like Ethereum, BNB Chain, and Polygon has increased significantly. The circulating quantity of the largest FIAT-pegged public stablecoins was measured at around $132 billion on the 17th of August 2022. In two years, the circulating supply grew 880%. However, in only four months after the Terra LUNA crash, stablecoins circulating supply plummeted by 10% ($14.94 billion).

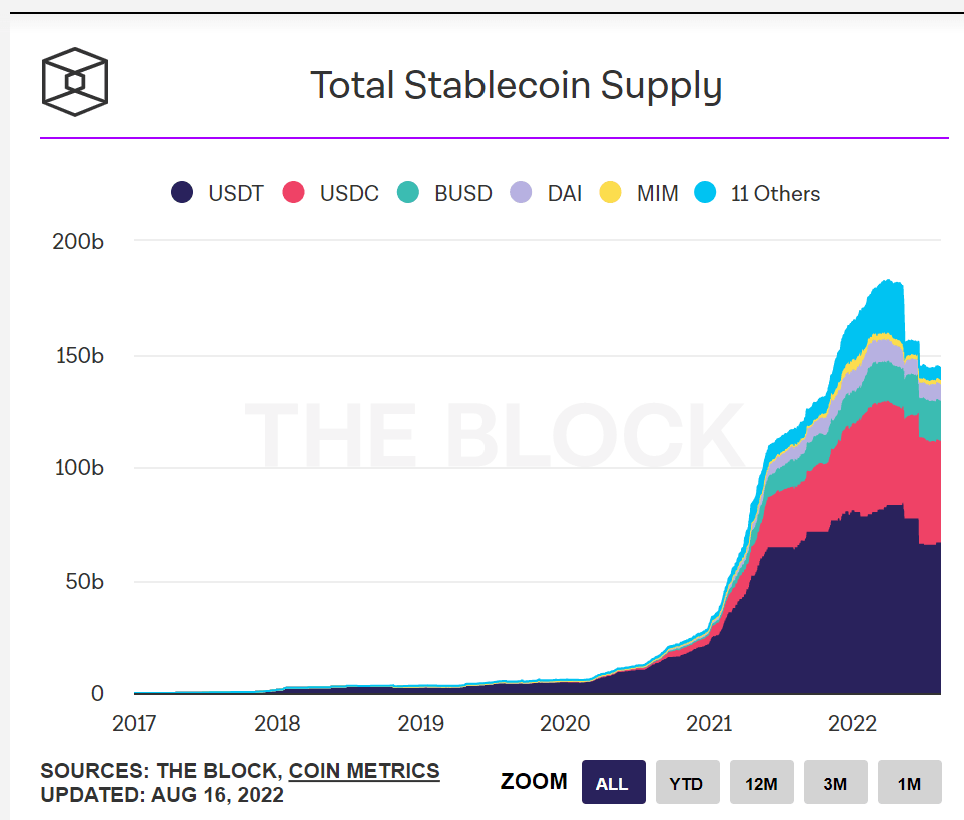

Looking at the total supply of stablecoins, we can observe that 92.42% of the value is represented by the fiat-backed stablecoins and currently is $142.82 billion, with an increase of 816% since August 2020. After the Terra Luna crash on the 9th of May, in just five days, the total supply decreased by 14.6% ($26.35 billion). It kept decreasing an additional 7% ( $11.34 billion) in June when crypto-company Celsius announced frozen withdrawals.

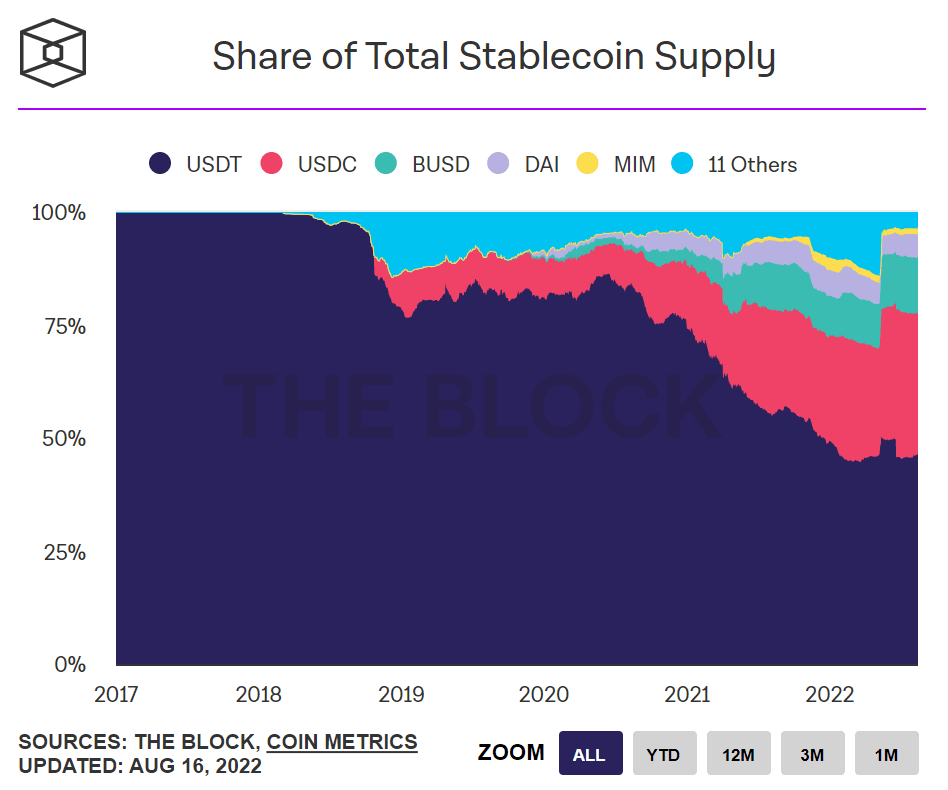

Regarding the dominance of the stablecoins, Tether USDT is the leader with 46.65% of the market share, followed by USDC with 31.41%, BUSD with 12.57%, DAI 5.09%, and 4.28% others.

It is crucial to note that in August 2020, the dominance of Tether (USDT) was 83.76%, a 44% decrease in two years. The dominance of the BUSD and USDC, on the other hand, has increased since August 2020, respectively, by 845% and 298%.

In the previous graph we can observe how the dominance of the 3 major stablecoins has increased, when Terra crashed. However, when Celsius announced the frozen withdrawals, Tether lost 5% ($12 billion). This scenario happened mainly because Tether was known as an early investor into the lending crypto company, contributing $10 million in equity investment to the lending platform in 2020. Also, the next year, in 2021, Celsius reportedly borrowed $1 billion from Tether with Bitcoin (BTC) as collateral.

It is important to note that Tether issued a statement explaining that its portfolio investments in Celsius had nothing to do with the health and backing of USDT.

What keeps a stablecoin pegged? Lessons learned from UST and aUSD

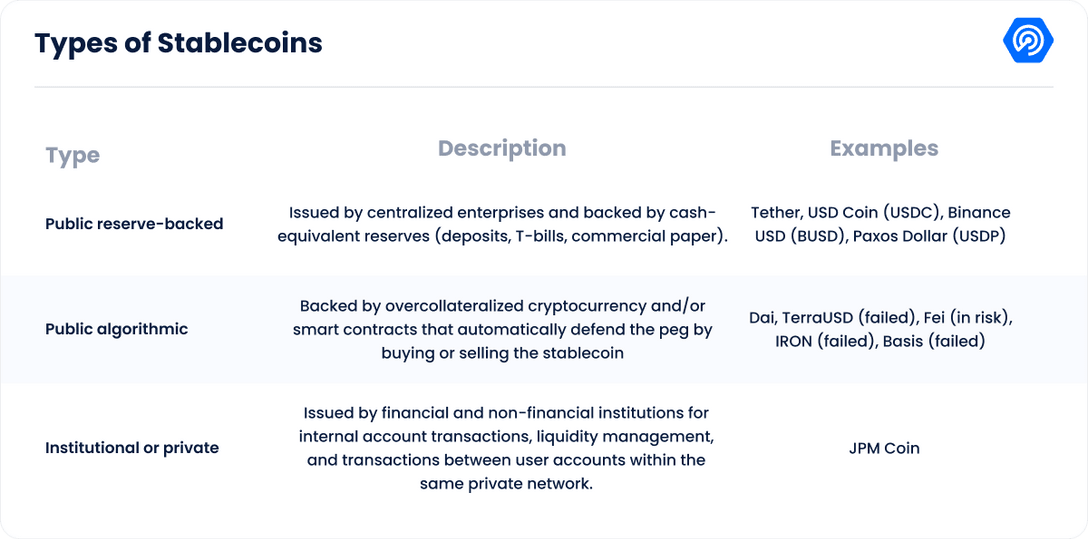

Perhaps the most important indicator of the performance of any stablecoin is how well the asset will hold its peg to its reference value. As shown in the table above, stablecoins can be classified from different perspectives, where each type will have its drawbacks.

At the moment, the main causes of peg instability for public reserve-backed stablecoins are the risk that investors will withdraw their money from the issuer and price fluctuations on the secondary market. The first is how safe and trustworthy a stablecoin’s reserves are.

If stablecoin holders start to doubt the backing of a stablecoin, it could cause a dynamic run. As stablecoin reserves are sold off or unloaded to satisfy the redemption demand, a run on a stablecoin increases the danger of spillovers to other asset classes.

A stablecoin run might also, via the use of interoperable smart contracts, harm the markets and services that depend on the stablecoin.

The second type of peg instability can happen with public reserve-backed stablecoins. In this case, there is a disparity between supply and demand on the secondary market. Because these stablecoins are traded on both centralized and decentralized exchanges, they can be affected by sudden changes in demand.

This could cause their peg to be temporarily broken until the stablecoin issuer changes the supply. Especially when the market is unstable, investors rush to turn their speculative holdings into stablecoins, which act as value stores on public blockchain-based marketplaces. As the issuer changes the supply, the price of major public reserve-backed stablecoins often increases for a short time.

The second type of stablecoins, those backed up by algorithmic models, appear to be a more risky approach. An example is Terra’s old UST, where the community regulated the price of their stablecoin.

If the UST price dropped to $0.99, for instance, LUNA holders may trade $1 USD worth of UST for $1 USD worth of LUNA and get the arbitraged difference. Consequently, LUNA relied on its customers to arbitrage the price differential and maintain price stability. For this system to be successful, a large population capable of absorbing whatever amount of UST the market hurled at them was necessary.

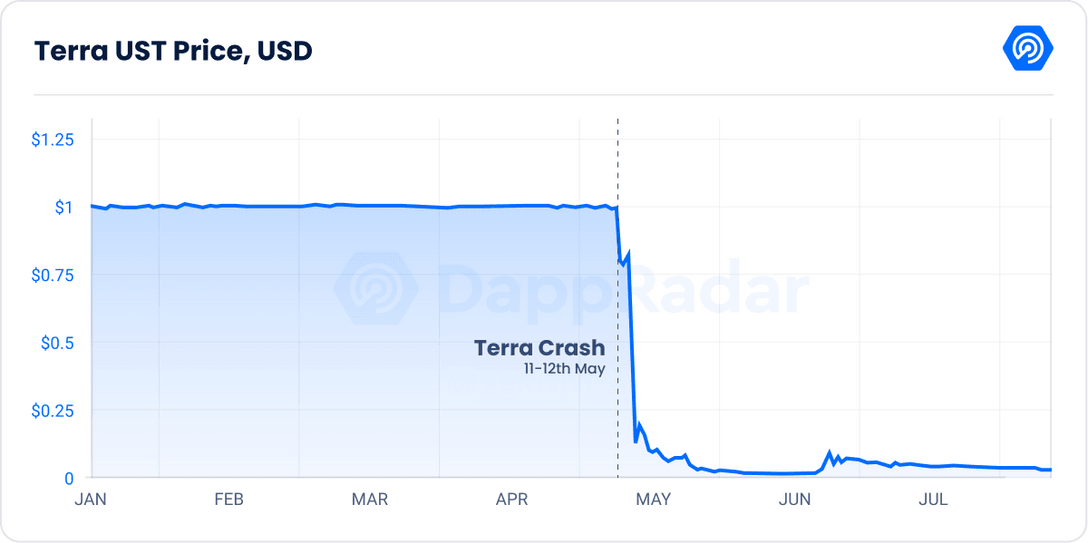

Since UST was not collateralized with real value when $84 million in UST were dumped on the market, the governance lacked the purchasing power to arbitrage the difference quickly. At that moment, the arbitrage exploit started to bring the whole system to its knees, also known as the Death Spiral.

At this period, the price of one UST was already $0.8. This signified that anybody who destroyed a UST in order to produce a fraction of a LUNA token would get $0.20. People continued to use this arbitrage method until both LUNA and UST had nearly lost all value.

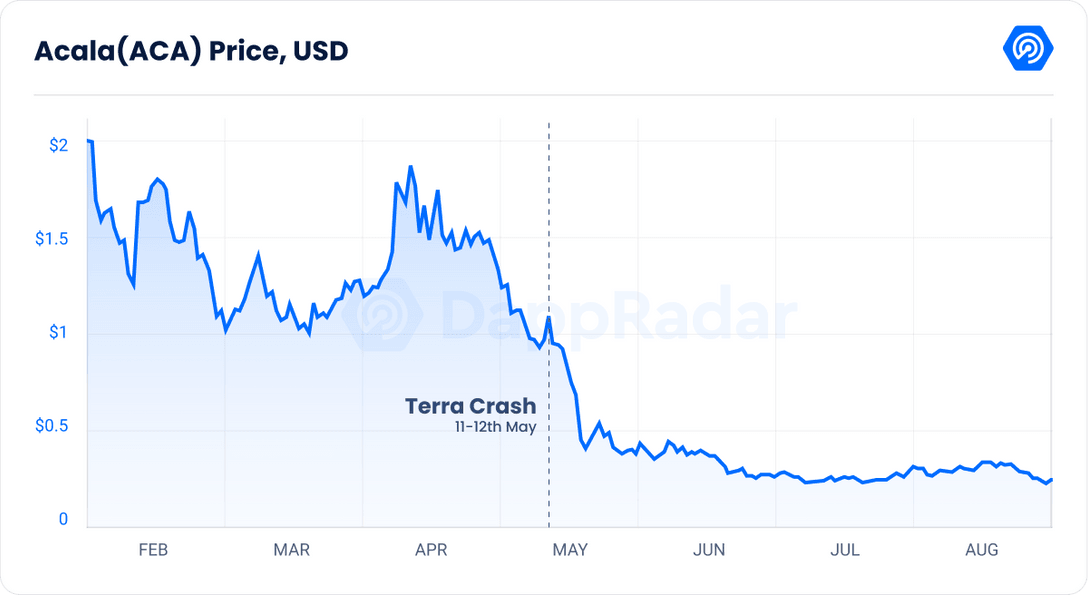

Another example of volatility in algorithmic stablecoins is Acala’s native stablecoin aUSD. However, the case of aUSD was caused by an exploit of a “misconfiguration” in one of its liquidity pools. As soon as attackers exploited the vulnerability, the mass minting of the stablecoin caused its value to collapse.

The network recovered quickly to destroy the 1.29 billion aUSD tokens owned by 16 wallet addresses implicated in Acala’s newly announced iBTC/aUSD liquidity pool smart contract hack. The Acala community voted on this burn plan on August 16th, which helped the aUSD quickly restore its dollar peg and is presently trading at $ 0.89, according to CoinGecko.

While the crypto contagion has had a significant effect on the current state of stablecoins, it was the recent events surrounding Tornado Cash that could have the final word on the future for stablecoins.

Tornado Cash unveiling MakerDAO’s Achilles’ Heel

The US Treasury sanctioned Tornado Cash on August 7, 2022, for allegedly helping North Korean hackers (presumably Lazarus Group) launder billions of dollars worth of stolen cryptocurrency. The US Treasury’s Office of Foreign Asset Control (OFAC), a regulatory department responsible for implementing sanctions, has verified the news, preventing US crypto users and companies from dealing with the system.

The OFAC list includes addresses directly related with Tornado Cash, such as its multiple mixing pools. It also references a Tornado Cash account used by the crypto grants program Gitcoin to accept contributions, the largest of which came from the hacker responsible for the $37.5 million Iron Bank breach in February.

- DeFi on Concordium: All You Need To Know

- EarthTones Music App & JADE Token: Revolutionizing the Music Industry in 2024

- Learn about how the Tornado Cash ban instigates a free speech battle

Adding an address to the OFAC list prevents the owner from sending or receiving USDC. In the past, most centralized stablecoin issuers, including Circle and Tether, have banned malicious individuals.

This time, leading stablecoin issuer Circle started by blacklisting 45 Ethereum addresses shortly as the US Treasury’s new penalties on Tornado Cash became public knowledge. This wallet veto approach has also been adopted by leading DeFi protocols such as UniSwap, Aave, Balancer, and dYdX have reportedly blocked blacklisted users.

Actions on Tornado Cash will undoubtedly affect the next wave of regulations. However, this report will focus on the potential effect on MakerDAO, and its stablecoin DAI, one of the most decentralized stablecoin offerings in the industry. DAI is the fourth-largest stablecoin, with a circulating supply of $7 billion, and its stability mechanism depends on USDC.

- OpenSea: Beginner’s Guide to Navigating and Using NFTs

- Yield Farming and Liquidity Pools: Understanding the Basics and Risks

- Read about how the Tornado Cash fallout could spread to Bitcoin

In light of this, MakerDAO may confront an existential crisis. The system, which promotes itself as an “impartial” and “decentralized” stablecoin accessible by anybody, has become dependent on USDC to maintain its dollar peg.

Half of all DAI were created initially from USDC deposits, but MakerDAO today backs its stablecoin with around a third of USDC. In the past, DAI benefited from USDC, which proved to be very steady during the year’s market turbulence.

However, the protocol’s susceptibility to USDC extends beyond a centralized treasury. The stability of the stablecoin is maintained by the Price Stability Module (PSM).

As its name implies, PSM assists in keeping the price of DAI linked to the US dollar, significantly when demand exceeds supply. DAI is created only when overcollateralized deposits are made to the system; if many individuals want DAI tokens but there is insufficient collateral, a supply crunch might cause the price of DAI to rise over the planned $1.

MakerDAO’s answer was PSM, which allowed USDC holders to exchange their tokens for “expensive’’ DAI at the dollar rate. It provides an instant and possibly profitable arbitrage opportunity when DAI’s price exceeds one dollar, which should motivate the price of DAI to equal USDC. Anyone may transfer USDC to MakerDAO’s PSM, after which the tokens are officially in MakerDAO’s custody.

This week, MakerDAO community members started developing a “contingency strategy” in case the suspension affects its “core” wallets.

Will Ethereum’s “Merge” affect the stability of the stablecoins?

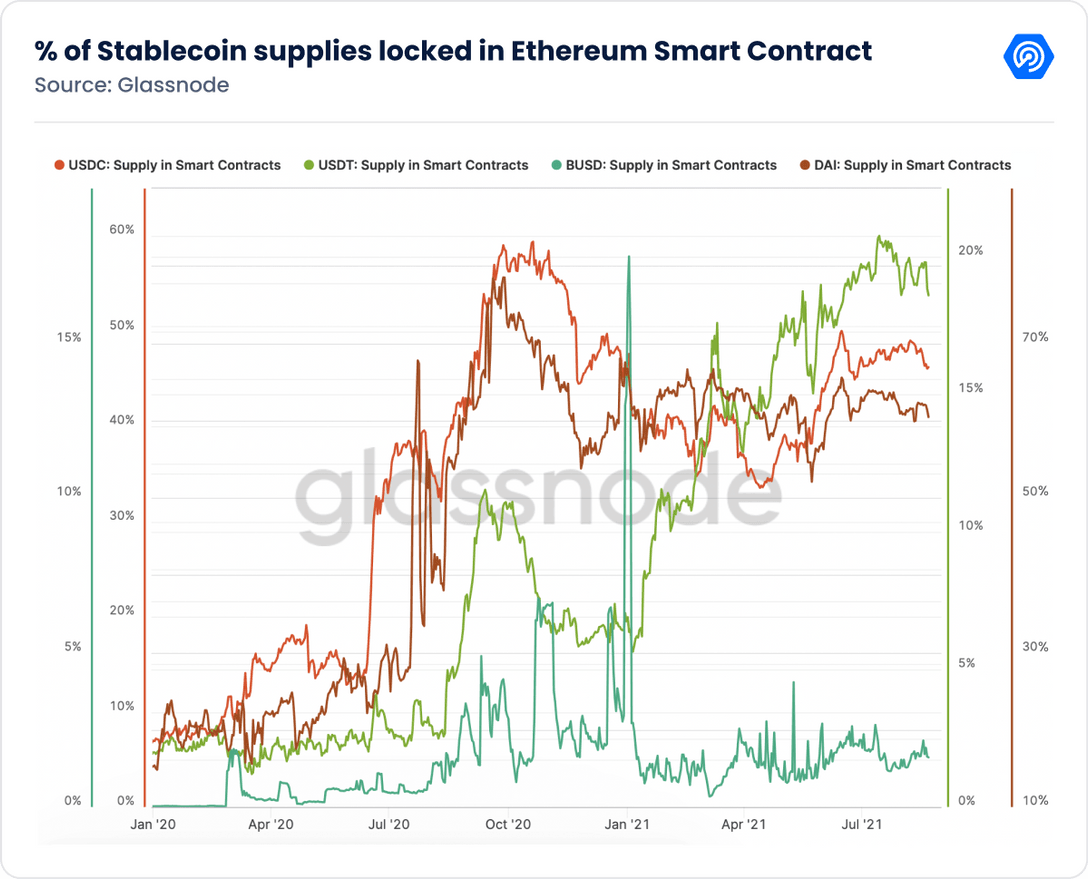

Stablecoins are central to the functioning of DeFi, as they are often used in DeFi arrangements to facilitate trading or as collateral for lending and borrowing. For example, stablecoins often are one asset in a pair of digital assets used in so-called “automated market maker” or “AMM” arrangements.

The AMM is designed to create liquidity for others seeking to effectuate trades. As another example, stablecoins are frequently “locked” in DeFi arrangements to garner yield from interest payments paid by others borrowing those stablecoins from the arrangement for leveraged trading or other activities.

Although unverified, industry measures for the size of DeFi participation include the percentage of stablecoins that are “locked” in Ethereum smart contracts. Ethereum currently is the predominant blockchain on which DeFi protocols and applications function. This is the reason why “The Merge” is one of the most anticipated events in blockchain history, and is raising many questions about the stability of the stablecoins, once the transition is done.

The Merge will shift the Ethereum blockchain (native token ETH, or ether) from a proof-of-work (PoW) consensus mechanism to a proof-of-stake (PoS) consensus mechanism that uses over 99.9% less energy. As a result, transactions will be conducted on the new proof-of-stake network and new ETH tokens will be minted by nodes on the network and stake a fair amount of ether tokens into a pool to secure the network and validate transactions.

On the 9th of August, Circle, the issuer of the USD Coin (USDC) stablecoin pledged its full support of the ‘Merge’ through a blog post. Currently, USDC is both the largest dollar-backed stablecoin issued on Ethereum and the largest ERC-20 asset overall, with over $45 billion in market capitalization residing in the ecosystem at the time of publication. Its reserves are audited and held at U.S. financial institutions such as BlackRock.

After the announcement of Circle’s support, Tether – the issuer of the world’s largest stablecoin, USDT – has confirmed its support for the upcoming Ethereum Merge. They stated that embracing the Merge is fundamental to ensure that there would be no disruption to the community when using its tokens within DeFi platforms.

With the sheer size of these stablecoins and their heavy presence within the crypto market, their support of Ethereum’s Merge is significant. The support could see a smooth transition for the entire crypto sector to Ethereum 2.0.

The co-founder of the Ethereum blockchain, Vitalik Buterin, had earlier warned that the power held by stablecoins could cause issues in future blockchain hard forks. According to Buterin, centralized institutions like Tether and Circle could choose to use the forked blockchain to fit their own needs instead of focusing on the proposals made by the Ethereum community.

But not everyone is enthusiastic about this ‘Merge.’ MakerDAO (MKR), the builder of the stablecoin DAI, has claimed in a Twitter thread that the merge could do more harm than good. They explained that the Merge could lead to perpetual contract backwardation and negative funding. Additionally, MakerDAO mentioned that the launch could trigger selling pressure across chains existing on PoW.

Another risk highlighted was the possibility of assets becoming worthless on already staked Ethereum (stETH). Maker considers this a big concern as it has operated through the system lending protocols. Additionally, it pointed out that lending protocols risk getting higher ETH deposit rates due to increasing liquidity due to the merger fork.

There’s also the potential of network downtime because not all Ethereum-based protocols would move to PoS with the Ethereum chain. Maker noted that this could affect users and transactions alike. Similarly, a replay attack on DAI-fork or MKR-fork was not left out of the options.

Also, Grayscale expressed concerns over the potential impact on the Merge, especially on tokens that run natively on Ethereum. The crypto investment firm believes that the Merge may lead to a fork that might have unexpected and unfavorable outcomes.

Grayscale’s concern is that the Merge might create a scenario where stablecoins and tokens locked in smart contracts might not be redeemable.

The crypto investment firm also notes that token and stablecoin holders might panic and start liquidating their holdings. Such an outcome would create a substantial amount of sell pressure.

While Grayscale and MakerDAO’s concerns are genuine, Ethereum developers have likely taken them into account. The ‘Merge’ will presumably transfer PoW Ethereum data and serve as a handoff. A parallel chain would inevitably result in duplication. However, the strategy and measures for addressing such concerns remain.

DeFi protocols announce new stablecoins seeking users and liquidity; will it work?

The recent rise in popularity of algorithmic stablecoins and the collapse of the Terra project have drawn attention to stablecoins by highlighting the critical role dollar-pegged assets play in the cryptocurrency ecosystem.

Multiple protocols have proposed new stablecoin efforts to fill the void left by the United States Dollar (USD) and obtain liquidity. The DeFi sector is riddled with gimmicks designed to enhance user involvement, and, likely, stablecoin launch activities are only the most recent trend utilized to improve TVL on DeFi platforms.

Let’s look at some of the most recently announced stablecoins that may reach the market.

On July 27th, Aave firms proposed to their community the deployment of a new stablecoin GHO on the Aave protocol and the ability for all users to mint additional GHO tokens by providing enough collateral. This stablecoin will be an algorithmic stablecoin that pays interest on the underlying asset, and it will be backed by many cryptocurrencies as opposed to dollars.

Aave Companies has previously warned prospective GHO users on the offering limits, the peg stability module, the interest rates determined by the DAO, and the potential facilitators.

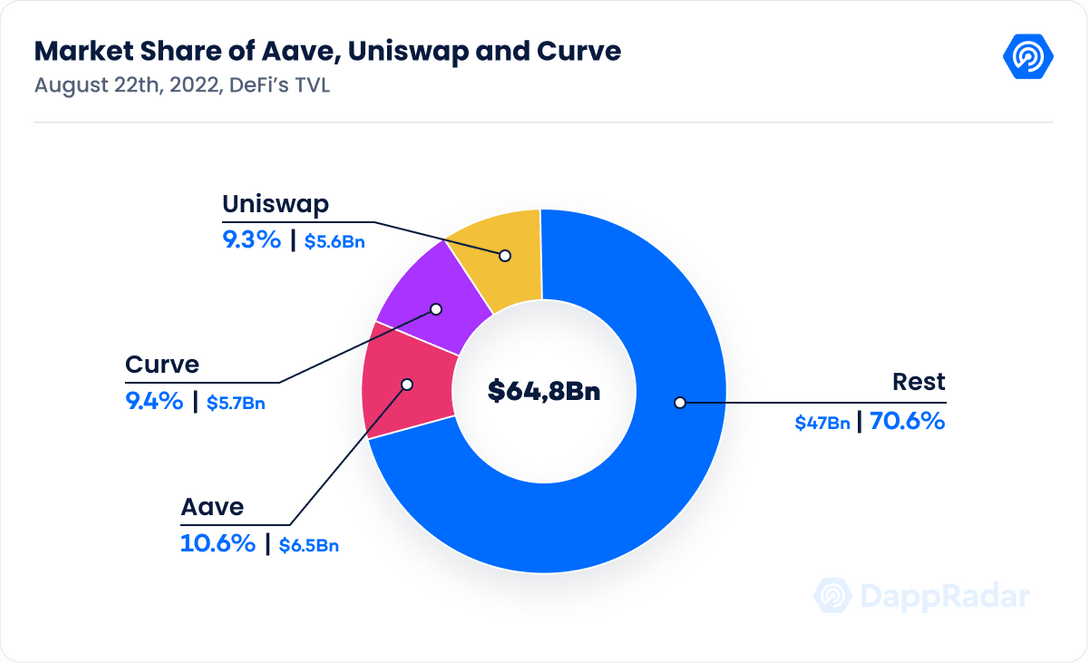

The DeFi Aave protocol is the third most valuable in the world for TVL, with a value of around $6.5 billion, followed by Uniswap and Curve. To give liquidity to cryptocurrency markets, its primary job is to borrow and lend cryptocurrencies.

Furthermore, SHIBA Inu ecosystem revealed its own stablecoin, a new token, and a collectable card game for its future metaverse.

The project’s creator said in his blog post that the collapse of TerraUSD (UST), precipitating a crisis in the stablecoin market, prompted the Shiba Inu community to create its stablecoin.

Kusama claims that Shiba Inu’s forthcoming stablecoin, SHI, could “avoid the flaws discovered” in other assets in this category because it was independently developed by “a group of developers in our decentralized network.”

Other specifics concerning the tokens and the new card set have not yet been disclosed, and the release date cannot be determined. However, Kusama said that if all goes according to plan, the stablecoin would be issued later this year.

Kujira, the crypto project that was building on the Terra Classic blockchain and moved to layer 1 protocol Cosmos after Terra’s implosion, announced on the 8th of August that it is about to develop USK, an over-collateralized Cosmos stablecoin soft-pegged to the US dollar and initially backed by ATOM, in response to the May collapse of Terra and its affiliated stablecoin TerraUSD.

The project also wishes to avoid depending on larger centralized stablecoins such as USD Coin (USDC) and Tether (USDT), saying that “decentralized money requires decentralized stablecoins” to preserve project sovereignty and prevent the possibility of censorship.

In addition to the new USK token, Kujira currently provides retail investors with three separate DeFi products: ORCA for capital liquidation, the FIN decentralized exchange (DEX), and the BLUE governance protocol. A native cryptocurrency wallet is also under development.

Potential regulations that could impact the future of stablecoins

For a long time, regulations lagged behind the cryptocurrency industry’s explosive growth and ongoing technological advancements. The transfer to crypto assets was delayed down by the legal environment’s uncertainty, yet stablecoins continued to see exponential growth.

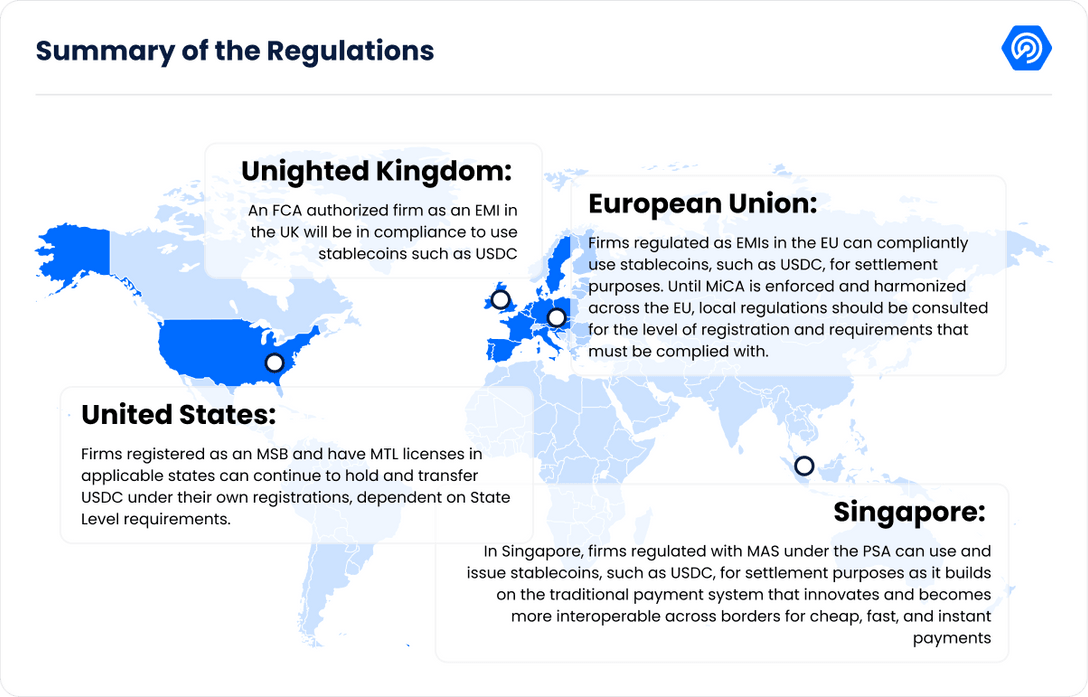

Some of the world’s largest economies have now begun to establish legislation that identify, comprehend, and frame crypto assets, provide clarity and safety, and keep pace with the rate of change. Stablecoins have previously been established by the United Kingdom, European Union, United States, and Singapore, showing that these countries believe in them and anticipate their widespread adoption.

Here is an overview of stablecoin regulation as of right now:

European Union

Since 2018, the EU has been creating Regulation of Markets in Cryptoassets (MiCA) measures to assist in regulating out-of-scope crypto assets and associated service providers in the Union. On June 30, 2022, EU legislators approved the historic law that would govern cryptocurrency assets and service providers throughout the continent’s 27 member states.

By requiring stablecoin issuers to amass a sufficiently liquid reserve with a 1:1 ratio and partially in the form of deposits, MiCA will safeguard customers. The issuer will at all times and without charge, make a claim available to every so-called “stablecoin” holder. The regulations controlling the reserve’s activities will guarantee sufficient minimum liquidity. Issuers must have reserves sufficient to pay for all claims and provide holders the opportunity for a quick redemption. A daily transaction limit of 200 million euros will apply to stablecoins.

By 2024, MiCA hopes to provide a unified licensing system across the EU. After it is passed, the legislation will immediately apply to all EU members and companies who want to do business there. The approval of MiCA by the European Parliament has opened the door for crypto-regulation that is conducive to innovation and can become a global standard. However, it won’t likely go into effect until the end of 2023.

Stablecoins like USDC are analyzed under the “e-money token” category of crypto assets, which is described as a kind of digital asset whose primary function is to be used as a medium of exchange and which claims to maintain a steady value by referencing the value of fiat money. Token and fiat-backed stablecoin issuance is likely to fall within the “crypto-asset service provider” category.

Recently, a modification to MiCA was suggested to restrict the usage of cryptocurrencies that employ the power-hungry proof-of-work algorithm. The parliamentary committee rejected this idea in March 2022 because the proposed regulation may have made cryptocurrencies illegal across the EU. The European Commission will, however, include crypto-assets mining into the EU taxonomy for sustainable activities by 2025 to lessen the carbon impact of cryptocurrencies. Additionally, initiatives for consumer safety and protection got approval.

United States

The definition of “money transmission services” currently includes transactions using stablecoins. This indicates that a company is considered a money transmitter under the Bank Secrecy Act if it accepts and transmits activity in stablecoins. Due to the division of the US regulatory environment into several regions, it is essential to notice that rules differ by state. In this situation, stablecoins may be governed by money transmission laws, and depending on the activity level, money transmission licenses (MTL) would be necessary. Additionally, businesses must register as Money Service Businesses (MSB).

Stablecoin issuers like Circle, who applied to become a full-reserve national commercial bank in 2021, are subject to the current talks over stablecoin regulation. After receiving a banking license, it will be subject to governmental control and rules like banks. In other words, the USDC issuer Circle complies entirely with all current requirements and will do so.

The “Stablecoin Transparency of Reserves and Uniform Safe Transactions Act of 2022,” or Stablecoin TRUST Act for short, was announced by the United States to outline how the country’s various regulatory agencies could deal with businesses that issue cryptocurrencies with prices tied to the dollar or other assets.

A “payment stablecoin” would be defined in the discussion draft of the legislation, the Office of the Comptroller of the Currency (OCC) would be given the authority to develop a new license specifically for stablecoin issuers, and insured depository banks would be permitted to issue payment stablecoins and state regulatory oversight of this area of the cryptocurrency industry would be addressed.

United Kingdom

On July 20, 2022, the UK government made the Financial Services and Markets Bill available for its first reading. The 335-page measure asserts its main objective is “to make provision on the regulation of financial services and markets; and for related purposes.” However, the bill’s emphasis on imposing laws and regulations regarding “digital settlement assets,” a novel term that has not yet been defined in law, is of fundamental relevance to the blockchain community and individuals who use digital assets.

The term “digital settlement assets” (DSAs) is used throughout the legislation and is defined as a digital representation of value or rights that, whether or not they are cryptographically secured:

- employs technology that supports the capture or storage of data,

- maybe shared, saved, or exchanged electronically,

- and can be used to fulfil payment obligations (which may include distributed ledger technology).

The UK government intends to regulate this area gradually. It now aims to change the current electronic money and payment system regulatory frameworks to bring actions that facilitate the use of certain stablecoins, when used as a method of payment, into the UK regulatory perimeter.

Given that the bill has just recently had its first reading and that the second reading is scheduled to be heard by Parliament on September 7, 2022, it may take some time before it becomes a major law in the UK. Following the second reading, it will be sent to a committee for assessment and a report before returning to Parliament for the third and final reading. After passing, the procedure is repeated in the House of Lords before any modifications are taken into account, and the bill (in whatever form) wins royal assent to become UK law, likely with the assistance of secondary legislation that has not yet been created.

Singapore

The creative usage of crypto tokens in value-adding use cases is highly encouraged by the Monetary Authority of Singapore (MAS), the regulatory agency that oversees stablecoins. A forward-thinking regulator, MAS started looking at CBDC projects as early as 2016, demonstrating this.

The Payment Services Act 2019 applies to stablecoins, which might be categorized as “digital payment tokens” (PSA). Fiat-collateralized stablecoins tethered to the value of a currency may fall within the PSA’s definition of “e-money.”

Stablecoins may be used in Singapore by businesses subject to MAS regulation under the PSA. They must not be advertised to the general public, but they may be marketed or advertised on business websites, mobile applications, or social media accounts.

Conclusion

Stablecoins do not exist in a vacuum; in addition to competing with more volatile crypto assets, such as Bitcoin, they compete with national legal tender currencies. The success or failure of central banks in controlling national currencies will undoubtedly affect the future of stablecoins and cryptocurrencies.

However, stablecoins do not only provide formidable competition in the market for currencies and money. Digital assets including stablecoins are ushering in a new age of monetary innovation and motivating established organizations like central banks to re-examine the nature and potential of one of our oldest institutions, money, and its function in the financial system